In early 2020, the world was hit by the COVID-19 virus, causing a crisis in many sectors and also having a clear impact on the energy system. In this article, we take a closer look at the short-term and long-term impact of the coronavirus on the energy system, and highlight some research and regulatory issues.

The challenge: Europe climate neutral by 2050

At the end of 2019, the Green deal, describing the ambition to make Europe the first climate-neutral continent by 2050, was published. Shortly after, the world was hit by the COVID-19 virus, triggering a crisis in many sectors and having a significant impact on the energy system. In this article, we take a closer look at the short-term and long-term impact of the coronavirus on the energy system, and highlight some research and regulatory challenges.

For 2020, the International Energy Agency (IEA) has estimated an 8% drop in global CO2 emissions [1], mainly driven by the economic impact of the corona crisis. This 8% would be the annual decline needed to meet the 2050 climate goals and limit global warming to 1.5 °C. As a consequence, the simple conclusion should be that the economy needs to go into lockdown annually to achieve this goal. Such reasoning ignores the technological sustainable options to meet the demand for energy services, the investments that have to be made anyway in the energy transition and the accompanying opportunities a sustainable transition can offer to cope with the economic crisis caused by the corona virus.

"Investments in renewable energy sources temporarily slow down but do not stall."

In 2016, the European Commission estimated in the 'Clean planet for all' study that additional investments of more than 100 billion euros a year are needed in the EU to remain in line with climate ambitions [2]. In Belgium, for example, approximately 1 billion euros (1 G €) in investments would have to be made annually to make more than 50% of our own electricity production renewable by 2030. These investments should not merely be seen as costs, but go hand in hand with structural value creation, a reduction in operational costs (e.g. fuel costs) and an increase in comfort for citizens. The 1 G € in investments in electricity production generate an estimated saving of more than 1.1 G € in natural gas costs or electricity imports in Belgium.

The IEA expects a slowdown in renewable energy investments in 2020, with an estimated 13% less new capacity installed compared to 2019, yet an increase in the total renewable park of 6%. If the supply chain recovers, the installation of new capacity is expected to fully resume in 2021. After all, the declining line of costs for PV and wind continues: in Dubai, a bid for a solar park was approved at 1.5 c € / kWh, a record [3]. And early May, the Netherlands Enterprise Agency (Rijksdienst voor Ondernemend Nederland) announced there were several candidates for the tender for subsidy-free offshore wind energy [4].

In the context of an economic recovery plan after the corona crisis, it will be absolutely essential for the regulator to make smart use of available resources and make choices that are sustainable and future-oriented. We will take a closer look at the electricity system, providing a picture of the future outlook and pointing out some technical points of attention for the current system. We then further explain the importance of policy decisions in more detail.

"The corona crisis: a glimpse into the near future of electricity production."

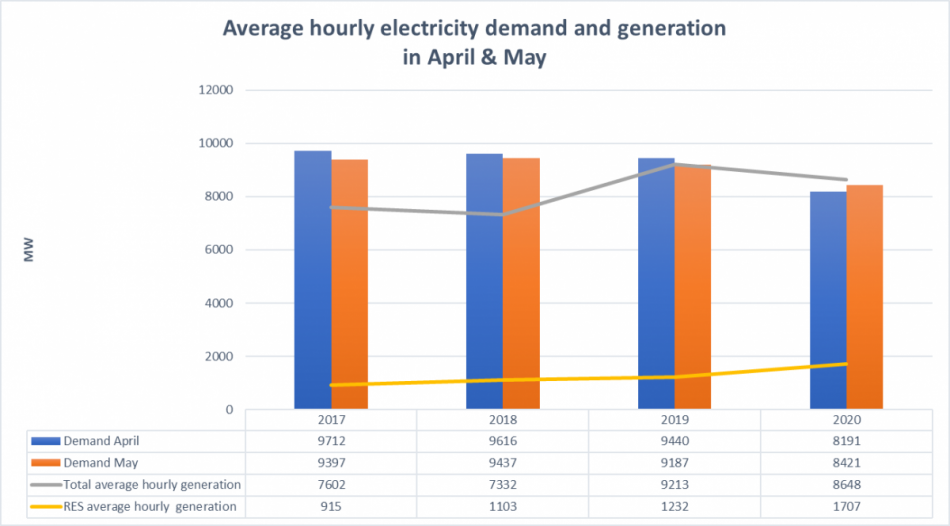

The current corona crisis has already taught us some interesting things in several areas. Due to the temporary decline in demand and several time periods with plenty of wind and sun, electricity generation was more than ever dominated by renewable energy sources. In April there was a 17% decrease in electricity demand and in May a decrease of 11% compared to previous years was noted, mainly caused by the corona crisis (see Figure 1). This decrease is mainly related to lower activity in the industrial and commercial sector. More details about the figures can be found in [5].

In contrast to demand, electricity generation in April and May 2020 was higher than in 2017 and 2018. It is clear that in 2017 and 2018 a lot of electricity had to be imported, while in 2020 in Belgium on average there was more generation than demand. In addition to the high share of renewable energy, this is due to the availability of the nuclear power plants, which was significantly higher in 2019 and 2020. The share of renewable generation in the total electricity generation increased to about 20% in 2020.

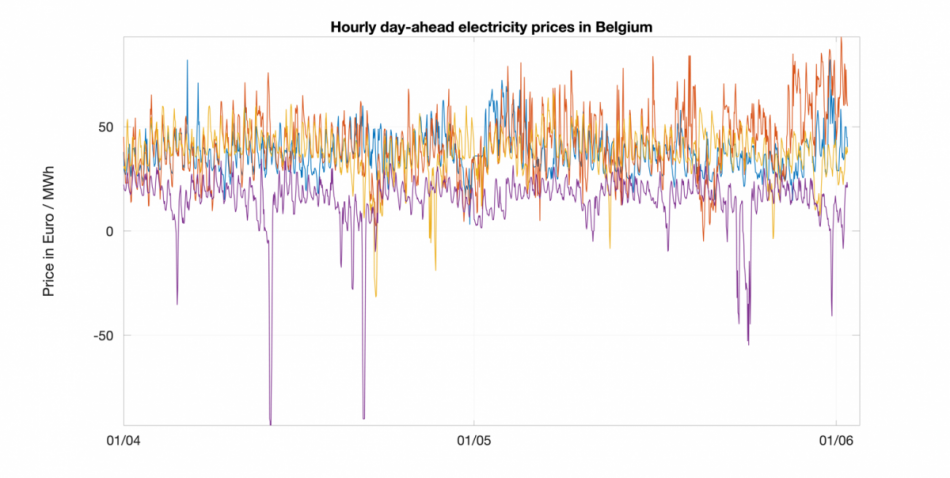

The combination of low demand and a high share of renewable energy generation in Belgium and neighbouring countries has strongly influenced electricity prices. Negative price spikes were recorded for 75 hours during April and May, compared to less than 100 hours in total in 2019.

Below you can find the price evolutions in Belgium: where the negative peaks are clearly noticeable.

In the medium term, the relative share of renewable energy will sharply rise encouraged by climate targets and decreasing costs. Intermittent sources will hence dominate the electricity system in the not too distant future. In 2030, in a cost-optimised system, half of Belgium's electricity generation will be renewable [6]. Without strong progress in flexibility and short-term dynamic storage, we would see the picture of negative prices much more regularly.

Wanted: Flexibility, storage and new market models

As clearly demonstrated by the example above, in times of overproduction and low demand (or vice versa in times of power scarcity) there is a need for market mechanisms that allow balancing demand and generation through demand response and/or storage. This requires a regulatory framework that makes it interesting for consumers to shift their electrical consumption over time. Especially for small consumers, the potential for flexibility on the demand side is almost untouched (apart from the old-fashioned approach of night rates, where too low demand at night was jacked up to use and store the excess energy from nuclear power plants during the night hours as hot water). Residential consumers for example do not sense fluctuations yet in electricity prices during the day. Day/night net metering and the associated tariffs are not able to allow consumers to respond flexibly to the electricity price. This requires digital meters that can register when electricity is consumed or injected. Heat pumps and electric vehicles can similarly offer flexibility if controlled smartly. In addition to electric vehicles and heat pumps, a number of additional industrial processes can also be electrified and used flexibly. Not only flexibility in demand but also different types of storage will be necessary.

"The moment when energy is consumed will gradually become more important than the amount of energy consumed."

Batteries are very suitable for short-term storage (hours to day/night), but have too little energy content to be interesting in the long term. For a slightly longer storage period, the electricity can be converted into heat. This entails the possibilities of meeting the heat demand with 4th generation district heating.

Apart from the flexibility and storage possibilities, it is a crucial question whether the current market system, based on marginal production costs, is sufficiently capable of attracting the necessary investments. Different variations of market mechanisms such as local energy exchange, flexibility services and capacity mechanisms should be tested in large pilot projects.

Case: Smart charging of the leased electric car fleet

An electric engine is more than 4 times more efficient than a combustion engine. The switch to battery-driven electric vehicles therefore has a positive impact on the final energy consumption, greenhouse gas emissions and local air quality. Mass simultaneous charging of electric vehicles can cause local problems on the distribution grid and cause peak consumption at unwanted moments. Smart charging is a solution here.

Targeted electrification of the Belgian lease fleet could generate at least 500,000 electric vehicles by 2030 [7]. The average commuting distance that is travelled daily in Belgium is approximately 32 kilometres. With an average consumption of 190 Wh/km, this means that on arrival at work, about 6 kWh of electricity can be charged per vehicle. If we suppose that 30% of the lease cars can be charged smartly in 2030, for example geared to local PV generation, we are talking about an electricity demand of approximately 1 GWh that can be flexibly controlled. On a sunny day, charging can be delayed until noon, when local PV generation peaks, to leave home at the end of the workday with a full battery. On a cloudy day, loading can be spread evenly throughout the day to avoid peak demand.

1 GWh corresponds to the production of 1/5th of the current total PV capacity in Belgium on a sunny day for 1 hour.

Hydrogen, where a vision of the energy system is required

Hydrogen has been placed high on the agenda in recent months, with ambitious plans in the Netherlands, Belgium and Germany to invest in production units, including in the North Sea [8]. Should Belgium speed up in financially supporting hydrogen projects? Which applications of hydrogen have the most potential? And can we wait a little longer, or are we then missing the (hydrogen) boat?

Before answering these questions, we take a closer look at how hydrogen, the lightest molecule but not freely available in nature, can be produced.

- The separation of methane (CH4), in a process called steam cracking, is the most common method. This is called gray hydrogen. CO2 is released during this process.

- When 80 to 90% of the CO2 is captured in this process, you get blue hydrogen. This CO2 can be stored or further processed in other products. An interesting technology is the pyrolysis of methane, which produces solid carbon instead of gaseous CO2. Pyrolysis, however, is still immature technology.

- Green hydrogen is produced by means of electrolysis, in which pure water (H2O) is split into oxygen and hydrogen.

- 2H2O + Electric energy => 2H2 + O2 + heat

- In some processes, such as chlorine production, hydrogen is a by-product and often flared.

Just to be clear, hydrogen is colourless. These terms used have nothing to do with the physical colour of hydrogen. Other techniques exist to produce hydrogen based on coal, biomass or in combination with nuclear energy, but we will not go into this further.

The main challenges for blue hydrogen are a high CO2 capture degree and an economically feasible roll-out of the infrastructure needed for underground storage of CO2. The storage potential for CO2 is large but finite, Gasunie calculated a technical potential in the North Sea of 1.7GtCO2, more than 10 times the current emissions in Belgium [8]. Of course, not all the technical potential is economically interesting. Belgium itself does not have such offshore storage fields.

In principle, hydrogen produced with renewable sources is emission-free. When using electricity from the grid to produce hydrogen, emissions from electricity generation must also be taken into account. If we consider the average European CO2 intensity of the current electricity generation mix (296 g/kWh), we arrive at approximately 16 kg CO2 emissions per kg of hydrogen produced [9].

Steam cracking of methane releases 7-9kg of CO2 per kg of H2 produced [10]. As a consequence, it can be concluded that green hydrogen only provides emission savings compared to grey hydrogen if the electricity generation is sufficiently carbon-neutral. Such massive surpluses of renewable electricity generation are unlikely for the next decade. In 2019 there were less than 100 hours available in Belgium, while a capital-intensive electrolyser needs 4 to 5000 working hours to be cost effective.

"In the next ten years, there will not be enough affordable carbon-neutral electricity to make green hydrogen interesting on a large scale."

Will Belgium miss the boat if it does not start subsidising hydrogen quickly? The answer is no. In the upcoming decade there will still be too little renewable energy available to make a large-scale roll-out of green hydrogen interesting. Of course, this does not alter the fact that a strong commitment to innovation and demonstration projects will be of great importance.

However, the possible applications of hydrogen are in theory numerous: transport, heating in the built environment, as raw material or process heat in industry. In practice, however, the scope of hydrogen is not always that relevant.

For transport, for example, one immediately notices a major disadvantage with regard to electricity, namely the energy losses. If one can use electricity directly in an electric vehicle, the entire chain (from generating electricity to driving the vehicle) has an efficiency of around 75%. When electricity is first converted to hydrogen and the same vehicle is powered by a fuel cell, the efficiency is only 30%. Where possible, it will therefore be more efficient to drive electrically directly than on hydrogen. What about range? Batteries are becoming more and more efficient and compact, but for long-distance or heavy transport the volumetric and mass density of a battery will still be too small for sufficient range. However, even under high pressure (600 bar) hydrogen still has a volumetric energy density that is almost seven times lower than diesel or methanol, which can be produced in a sustainable manner by combining hydrogen with CO2.

So-called power-to-X technologies can, however, be interesting for mobile applications such as aviation or for industrial applications. In doing so, other energy carriers or raw materials for chemistry are made on the basis of green hydrogen, such as synthetic methane, methanol or ammonia. The most future-oriented application and also the greatest demand for hydrogen can therefore be found in industry. This demand for hydrogen already exists today and will have to be greened in the future [9].

There is an urgent need to develop a calculated and scientifically based long-term vision that takes into account the future needs of the industry. In a recent study, the Wuppertal Institute calculated a possible increase in industrial electricity consumption of 34TWh (compared to 80 TWh in total electricity consumption today in Belgium), driven by electrification and production of green hydrogen, and taking into account the higher need of electricity in the neighbouring industrial clusters in the Netherlands and Germany [11]. On the other hand, there are also possibilities, Wind Europe calculated a potential of more than 200 GW of offshore wind in the North Sea and 450 GW in Europe. With a rather modest renewable energy potential on Belgian soil, we must focus on good electrical interconnections. The need for additional gas pipelines (natural gas, hydrogen and possibly CO2) is related to the generation/storage of molecules in the broad sense of the word. Partly thanks to our ports, we can play a central role in the future North-West European energy transition. Consultation with neighbouring countries and industrial clusters is essential in this regard.

"There should be a calculated long-term vision that supports investment policies in innovation and energy infrastructure. A dialogue with the Netherlands and Germany is crucial in this respect."

Sustainable recovery, what options do the policy makers have?

For the economic recovery after the corona crisis, it is extremely important that sustainable and future-oriented policy decisions are made. That is why Denmark proposed to use the basic principles of the Green Deal as a guideline for a sustainable economic recovery after the corona crisis. Already 19 countries in the EU have endorsed this question.

In the short term, many Member States are discussing financial support packages with sectors severely affected by COVID-19, such as aviation. There is yet no European strategy to link such support packages to climate conditions. For example, while the recent rescue deal with Lufthansa did not yet have any climate conditions, there are options such as fuel taxes, reduction of short-haul flights compared to train journeys, or the addition of carbon-neutral fuels.

Aside from the short-term support packages aiming at sustaining economic activity, it is important to look at the long-term sustainability and future potential of energy infrastructure investments. Several European countries recognise this and announced actions to further support the energy transition, whether or not as a direct response to the economic impact of COVID-19. Denmark is pursuing its ambitious plan to cut emissions by 70% by 2030. To achieve this goal, they plan, among other things, the construction of two artificial energy islands, good for 4 GW of additional offshore wind capacity (https://fm.dk/media/18017/faktaark-til-foerste-del-af-klimahandlingspla…). In the Netherlands, Minister Wiebes published a letter to parliament on 15 May with a vision of making the basic industry more sustainable. Not all of these initiatives are new or very specific, but it shows that European policymakers see sustainable investments as a good way to limit the economic consequences of COVID-19 as much as possible.

A recent study by Oxford University identified 5 so-called no-regret longer-term policy decisions with both high economic value and a positive impact on the climate: investments in clean energy infrastructure, natural infrastructure such as water management, renovation, education and training, and an increased commitment to sustainable research and development [12]. Investments in renewable infrastructure projects (not only solar and wind energy, but also district heating for example) can be interesting through the creation of technically skilled jobs in the installation phase.

A disclosed note from the European Commission shows that 1000 G € will be deposited in a broad stimulus program with the Green Deal as the central theme for the economic recovery, with special focus on renovation, renewable energy, hydrogen, climate-friendly mobility and circular economy [13]. This will support economic activity in the short term, but also create long-term economic value through innovation.

Yet following these general principles is not enough to guide economic investment policies. There must be a calculated and scientifically-based long-term vision that allows strategic choices to be made to guarantee the sustainability, reliability and competitiveness of the total energy system (electricity, gas and oil) and our industry. It is important that future investments are not only evaluated ad hoc on the basis of a revenue model for the next 10-15 years.

In the short term, it is important that an active dialogue is enabled with the Netherlands and Germany and the industrial clusters present there. As is evident from a letter from the cabinet to the House of Representatives, the Netherlands wants to focus strongly on innovation, in particular an accelerated roll-out of some technologies related to hydrogen, industrial electrification and carbon capture and storage/reuse [14].

The government plays an essential role as a facilitator in making the industry sustainable, especially in infrastructure investments, which are often characterised by long pay-back times, and in supporting high-risk projects with a high innovation potential. In addition, it is important that a detailed plan is set up that also examines the exact time scales.

In summary, the corona crisis has recently revealed some concerns for our energy system. The coming investment challenges are huge but also essential, and the economic impact of the COVID-19 crisis will make it critical for policymakers to make well-informed and sustainable choices in the time to come.

Bibliography

[1] https://www.carbonbrief.org/iea-coronavirus-impact-on-co2-emissions-six….

[2] European Commission Communication: A Clean Planet for all, ((2018) 773.

[3] https://www.pv-magazine.com/2019/11/22/dubai-confirms-saudis-acwa-won-9….

[4] https://www.rvo.nl/actueel/nieuws/meerdere-aanvragen-subsidieloze-tende….

[5] H. Ergun, J. Beerten and R. Belmans, https://www.energyville.be/pers/expert-talk-wat-leert-de-covid-19-pande…, 2020.

[6] https://www.energyville.be/energy-transition-belgium-choices-and-costs.

[7] X. May, „De netelige kwestie van het aantal bedrijfswagens in België,” 2017. [Online]. Available: https://journals.openedition.org/brussels/1541.

[8]North Sea Energy, Unlocking potential of the North Sea, Interim program findings June 2020.

[9] P. Vingerhoets and R. Belmans, Molecules: Indispensable in the decarbonized value chain, Florence school of regulation, 2020.

[10] Soltani, Reza & Rosen, Marc & Dincer, Ibrahim, Assessment of CO2 capture options from various points in steam methane reforming for hydrogen production., International Journal of Hydrogen Energy. 39. 10.1016/j.ijhydene.2014.09.161, 2014.

[11] Frank Merten, Christine Krüger,Stefan Lechtenböhmer, Clemens Schneider,Arjuna Nebel, Alexander Scholz, Ansgar Taubitz , Infrastructure needs of an EU industrial transformation towards deep decarbonisation, Wuppertal inst., 2020.

[12] Hepburn, C., O’Callaghan, B., Stern, N., Stiglitz, J., and Zenghelis, D. , ‘Will COVID-19 fiscal recovery packages accelerate or retard progress on climate change?’, Smith School Working Paper 20-02., 2020.

[13] https://www.euractiv.com/section/energy-environment/news/leaked-europes….

[14] https://www.rijksoverheid.nl/documenten/kamerstukken/2020/05/15/kamerbr…, 2020.

[15] EURACTIV, „https://www.euractiv.com/section/energy-environment/news/leaked-full-li…,” [Online].

[16] C. J. R. J. M. e. a. Le Quéré, Temporary reduction in daily global CO2 emissions during the COVID-19 forced confinement, Nat. Clim. Chang. : https://doi.org/10.1038/s41558-020-0797-x, 2020.

[17] Eckhouse, B., and C. Martin , ‘Coronavirus Crushing Global Forecasts for Wind and Solar Power,’, Bloomberg Green, 2020.

[18] Isabel François en Adwin Martens (WaterstofNet) Thomas Winkel en Wouter Vanhoudt (Hinicio) , Het potentieel voor groene waterstof in Vlaanderen, een routekaart, energiesparen.be, 2018.

[19] ‘Tomas Mathijsen, Ingrid Giebels en Peter-Paul Smoor, ‘De positie van waterstof in de energietransitie’, Over Morgen , 2018.